What Is a 401(k)?

A 401(k) is a retirement savings account that is sponsored by an employer. The account is funded by the employee contributing a percentage of their paycheck to the account each pay period.

The employer will typically offer a match benefit to the employees that decide to join the 401(k) plan. The match benefit is to encourage the employees to contribute a certain amount of their earnings into the account. The employer will then match the amount of funds the employee contributed into the 401(k). The employer match is typically limited to a certain percentage of the employee’s pay. The employee, or the owner of the account, is then able to direct how the money in the account is invested.

The employer, or the sponsor of the 401(k) plan, selects a series of investment options that the members of the 401(k) plan can choose from. These investment options are typically a series of mutual funds. The funds that are contributed into the 401(k) account are then invested until the owner of the account reaches retirement age and begins to take distributions from the account. These distributions are used to supplement the 401(k) owners’ retirement income needs. Upon reaching the age of 59 ½ then the IRS allows the owner of the account to withdraw the funds from the account penalty free.

Contributing to a 401(k) account

There are two different types of ways the employee can contribute to their 401(k) these two options are Traditional and Roth. Both options hold these names, because they are referring to when you pay income taxes on the funds that are contributed to the 401(k) account.

- Traditional (Pre-Tax): Traditional means the funds are contributed directly to the 401(k) without being paid to the employee first. This effectively lowers the amount of money paid to the employee. When contributing Pre-Tax dollars, the employee does not pay taxes on the money now, but they are required to pay income taxes on the funds when they are withdrawn from the 401(k) account. This is because the employee has not yet paid income taxes on these funds. Traditional contributions allow the funds to grow tax deferred. You don’t need to pay any income taxes on the funds until they are withdrawn from the 401(k) account.

- Roth (After-Tax): Roth means the funds are contributed to the 401(k) after being paid to the employee first. When contributing After-Tax dollars, the employee pays income taxes on the money now, but they are not required to pay income taxes on the funds when they are withdrawn from the 401(k) account. This is because the employee paid income taxes on these funds prior to them being contributed into their 401(k) account. Roth allows for tax free growth. The funds can be invested into the 401(k) account and grow for years to come without the need to ever pay income taxes on the money ever again.

Employer Match

Each 401(k) plan is different in its own way. Each 401(k)-plan sponsor, or employer, must decide how much it will offer as an employer match. This match will represent the dollar amount that the employer will also contribute to the account after the employee has also contributed to their 401(k) account. An example of an employer match is your employer offers a 100% match on all your contributions each year, up to a maximum of 4% of your annual income. If you earn $50,000 a year, the maximum amount your employer will match is $2,000 ($50,000 * 4%). In order to maximize your benefit from your 401(k) it is best practice to ensure you contribute 4% of your paycheck into the 401(k) account. Based on this example a total of $4,000 will be added into your 401(k) account. $2,000 will be added from your deferral and $2,000 will be added from your employer.

If financially possible, it is always best practice to contribute enough to get the full match from your employer. If you defer less than the employer match amount, you will essentially be leaving free money on the table.

Using the same information from the earlier example, if you only defer 3% to your 401(k) you will only be deferring $1,500 ($50,000 * 3%). Your employer will also only be deferring $1,500. This will mean you are essentially not taking advantage of $500 of free match money from your employer ($2,000 - $1,500).

Vesting

The funds contributed by your employer to your 401(k) account are subject to a vesting schedule. A vesting schedule represents the percentage of ownership of the funds in the 401(k) account that were contributed because of the employer match. The only time a vesting schedule is needed is when an employee leaves their place of employment. An example of a vesting schedule is listed below:

| Vesting Schedule |

|---|

| 1 Year: 33% |

| 2 Years: 66% |

| 3 Years: 100% |

According to this vesting schedule above, if you leave your place of work after working there for only 1 year you will be 33% vested. This means that if your employer had contributed $1,000 to your 401(k) account you would only be able to keep $330.00 ($1,000 * 33%) of that employer’s contribution amount. If you stay for more than 3 years you will be fully vested, and you would be able to keep the entire amount your employer match contributed into your 401(k) account.

Real Life Example

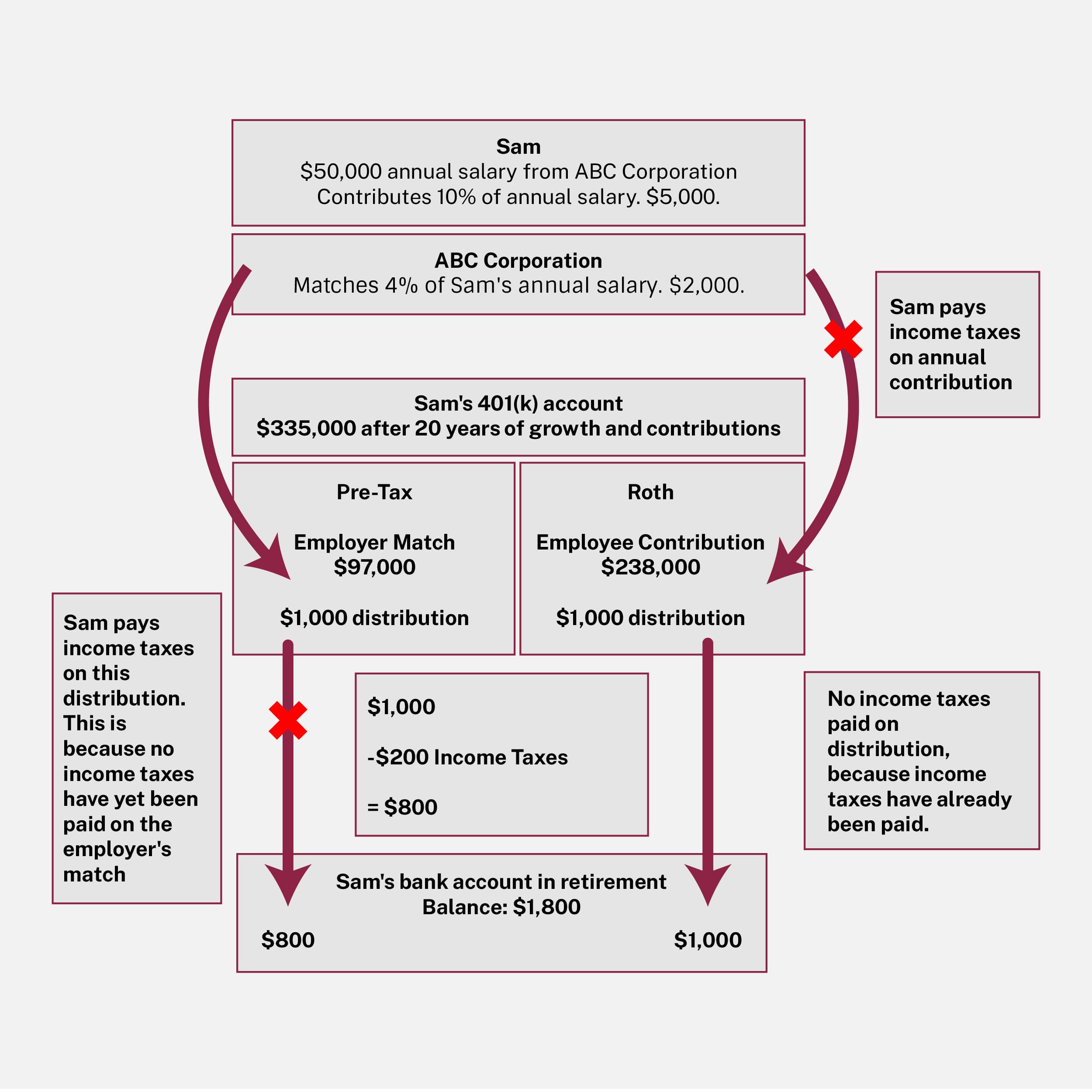

We have Sam who is 45 years old, and he works at ABC Corporation. ABC Corporation has an employer sponsored retirement plan which matches 4% of employee contributions. ABC Corporation 401(k) plan follows a 3-year vesting period. Sam makes $50,000 annually. Sam elects to contribute 10% of his paycheck into his 401(k) account, by deferring 10% Sam is taking full advantage of his employer’s matching contribution. Sam also decided to contribute that 10% in a Roth, after tax, fashion. This means Sam will pay income taxes on these funds now but will not need to pay income taxes when he withdraws the funds from his 401(k) in retirement. Sam is contributing $5,000 (10% * $50,000) annually and ABC Corporation is contributing $2,000 (4% * $50,000) annually. ABC corporation with be matching in a traditional, pre-tax, fashion. Meaning Sam will need to pay income taxes on these funds when they are distributed from his 401(k).

Sam decides to work until he is 65 years old. This has given Sam’s 401(k) 20 years of time to continue to grow. Over those 20 years Sam’s 401(k) has grown to equal $335,000! Since Sam worked at ABC Corporation for over 3 years, he is 100% vested. This means the entire 335,000 is all Sam’s. The below diagram will breakdown the details of Sam withdrawing $1,000 from both the pre-tax and the after-tax money from his 401(k) plan. We will see how he needs to pay income taxes on the $1,000 withdrawn from his pre-tax dollars, and he will not need to pay any taxes on the $1,000 withdrawn from the after-tax dollars.

How can Peoples Bank Wealth Management Group help?

Peoples Bank Wealth Management Group is an established provider of many employers sponsored retirement plans. We also provide expertise in the establishment of new plans as well as the continued management of previously established plans. Contact Peoples Bank Wealth Management Group to learn more how we can help you!