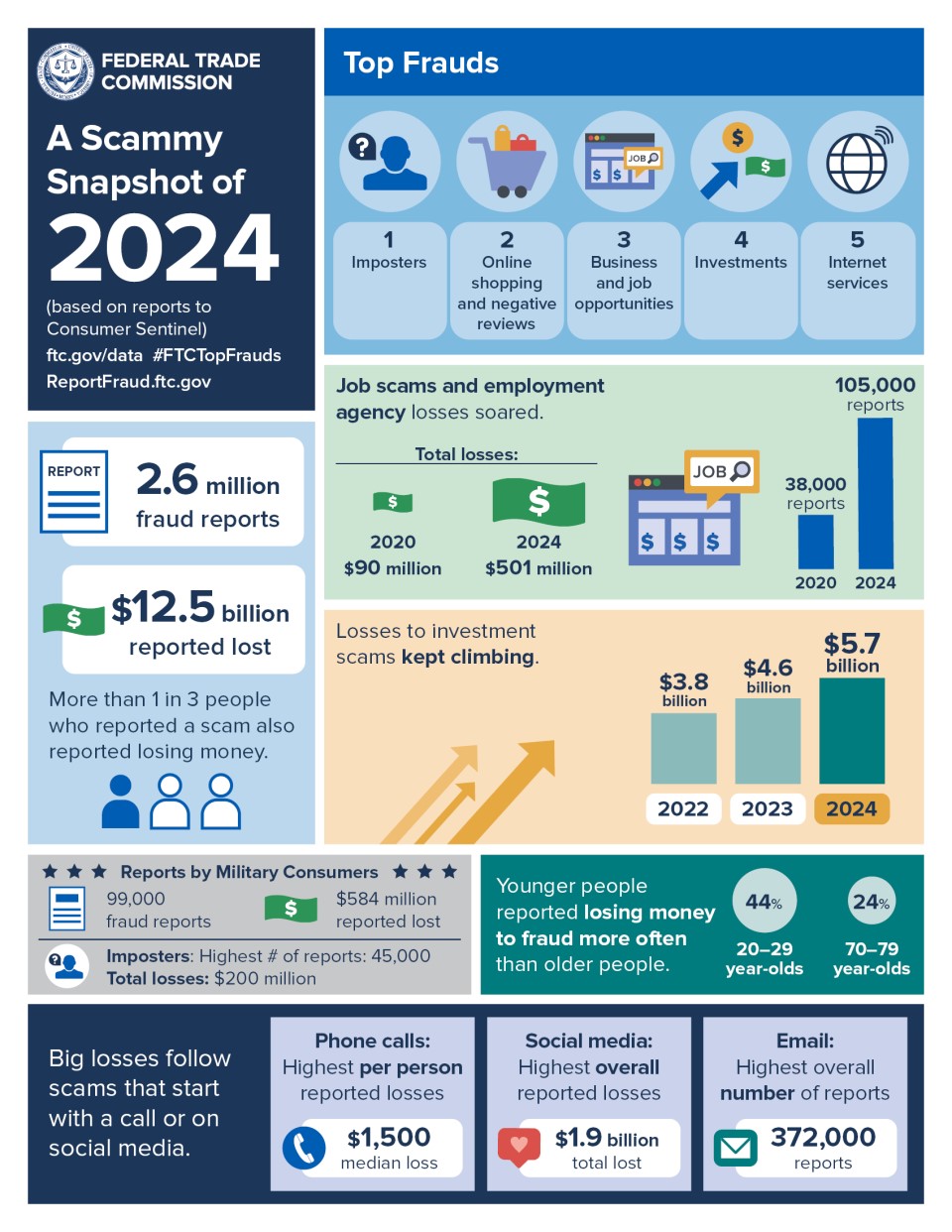

Scam and fraud are words we have become familiar with but oftentimes fail to recognize the severity of these words in action. The Federal Trade Commission reported in 2024 that 2.6 million instances of fraud were reported, $12.5 billion reported were lost, and a $5.6 billion loss to investments occurred. These numbers keep increasing and put everyone, even yourself, at risk. Specifically, in the United States, more than one in three adults who reported a scam also reported losing money. (Federal Trade Commission)

No one wants to be the victim of fraud, so what do you do? In this blog article, you will take the essential step of educating yourself against fraud. You will learn what common scams are occurring, how to protect your identity and financial accounts, and actions to take if you become a victim. Protect yourself by reading more!

Common types of scams

Scammers do not use one method to take your personal or financial information. Below are only a small number of techniques used to defraud individuals:

- Auto Fraud (on sites like Craigslist, Marketplace)

- Lottery/Sweepstakes

- Romance/Sweetheart

- Grandparents Scam

- Computer Hacking/Tech Support

- Debit Card/Social Media Shopping

- Crypto/Investments/Timeshares

- IRS or Government Imposter Scam

- Call Back Scheme

- Bogus Debts/Utility Scam

- Phishing/Text Messaging

- Business Opportunities or Employment (Craigslist or Social Media)

- Scareware/Ransomware

- Quishing

This list can be overwhelming, so let us take a deeper look at four of these common types of scams.

Scareware/ransomware

Technology has become vital to how we work and communicate with others. So, when technological issues occur, we want a solution as soon as possible. Scammers recognize this.

Scareware scams occur when a victim is directed to buy and download malware due to false issues. For example, a pop-up may come up stating your computer is infected with several viruses. A message or alert will then appear telling you to purchase a way to remove the viruses.

Ransomware also involves malicious software but results in a victim losing access to their data until they pay a ransom to the scammer.

With these scams, the scammer is attempting to highjack or extort money from the victims for use of their own computer. People are targeted to make impulsive, fear driven decisions.

If this happens to you, shut down and unplug your computer immediately. Take your computer or laptop to a local computer repair shop to have the malware removed.

Call back scheme

Scammers use call generators with automated spoofing capabilities to place calls to a large volume of U.S. cell phone numbers. The calls typically ring once and are from caller IDs with a high-cost international number, oftentimes located in the Caribbean. If you call the number back, you are greeted with a message to keep you on the line. One potential greeting is, “Hello, you have reached the operator, please hold.” The scammers receive revenue based on how long you, the caller, stay on the line.

If you receive a call that rings once and the caller does not leave a message, do not call the number back!

Quishing

Quishing, a type of phishing, is an attempt to gain access to personal or financial information to defraud individuals through a QR code. For example, a scammer will send an email with an attached QR code. If scanned, you will be sent to a website posing as a valid company, such as an online retailer or bank, and directed to enter your information.

It is difficult to know if a QR code link is fraudulent. This makes it even more important, as with any type of phishing, to treat any communication you receive that you did not expect with suspicion.

If this happens to you, directly call the company that is requesting information from you to see why the QR code was sent to you, and verify it is legitimate. Do not use the phone number on the email or package, but rather, search the phone number on the internet. Again, if you are not expecting it, be suspicious about it!

Grandparent scam

Lastly, scammers call elderly individuals and claim to be their grandchild in a financial crisis. The scammer may state they have been in a car accident or arrested in a foreign country and need money for bail, fines, etc. wired to them immediately. This puts an urgency to the claim, so the victim does not have time to think it over.

You can avoid this financial loss by always verifying such statements. Contact your family members or grandchild directly using a known phone number. Also, never send money based on an email or phone call without verification.

Tips to avoid becoming a victim:

Now that you understand what some common scams are occurring, let’s discuss how to protect your personal and financial information. Here are tips to avoid becoming a victim:

- Be aware of yourself, your surroundings, and criminal’s potential strategies.

- Trust your instincts.

- Contact your bank or the police if you feel like you are involved in a scam.

- If it’s too good to be true, it is.

- Beware if they are asking for your personal information.

- Never give out debit or credit card information through unsolicited emails or calls.

- Beware of winning a lottery you never knew you entered.

- Be cautious of doing business with individuals you do not know.

- Beware when money is required up front.

- Beware of sellers who only accept wire transfers, cash, or gift cards.

- Beware of subjects who send you checks or money orders that are more than your asking price.

- Never make quick decisions!

- Do an internet search.

- Do not accept your caller ID as gospel.

- Keep up to date on what scams are out there by going to ic3.gov.

What if you become a victim?

Anytime you are concerned that you are a victim of fraud that might impact your accounts at Peoples Bank, be sure to reach out to us immediately to report the incident and protect your hard-earned money. We will work with you to determine your risk, put holds or fraud alerts on your accounts, or contact authorities if necessary. We will also assist you in contacting the Social Security office and Credit Bureaus if necessary. The Federal Trade Commission also offers some great tips if you are scammed. Check them out here.

At Peoples Bank, we pride ourselves on the security measures we take to protect our customers, offering many options to help combat fraud, including our Fraud Center to notify you of suspected fraud and our ID TheftSmart, to help keep your identity and your finances secure.

In addition to contacting the bank, reach out to your local law enforcement.

If it is an internet crime, report it to ic3.gov.